Facing a lawsuit from Capital One can be a stressful experience, but understanding the legal process and knowing how to respond effectively can significantly increase your chances of getting the case dismissed. In this article, we will explore how to get a Capital One lawsuit dismissed, including the legal process, common defenses, steps to take before trial, possible outcomes, and real-life case studies. We will also include expert opinions and ensure the content is easy to understand and optimized for search engines.

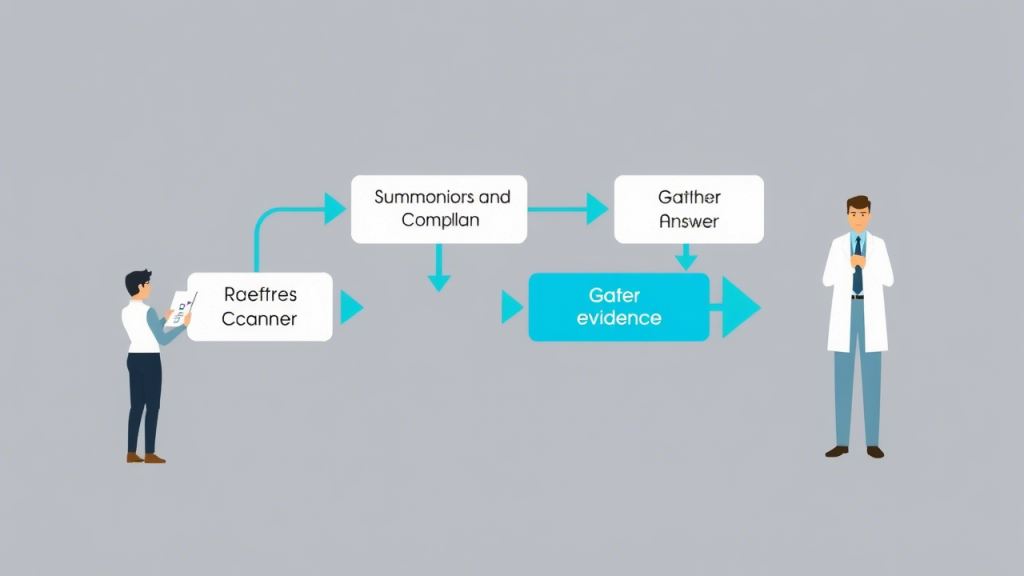

Understanding the Legal Process

Initiating the Lawsuit

A Capital One lawsuit typically begins when the bank files a complaint in court against you for an unpaid debt. This complaint outlines the basis for the lawsuit, including the amount owed and the reasons for the claim. You will receive a summons along with the complaint, which notifies you of the lawsuit and provides instructions on how to respond.

Responding to the Complaint

Once you receive the complaint, you have a limited time—usually 20 to 30 days—to respond. Failing to respond can result in a default judgment against you, meaning Capital One wins automatically without your input. Your response must address each claim made in the complaint, either admitting or denying them.

Discovery Phase

If you respond to the complaint, both parties enter the discovery phase. This stage involves gathering evidence, including documents and witness statements. Both sides exchange information that may be relevant to the case.

Pre-Trial Motions

Before going to trial, either party can file pre-trial motions. These motions can request various outcomes, such as dismissing certain claims or even the entire lawsuit based on specific legal grounds.

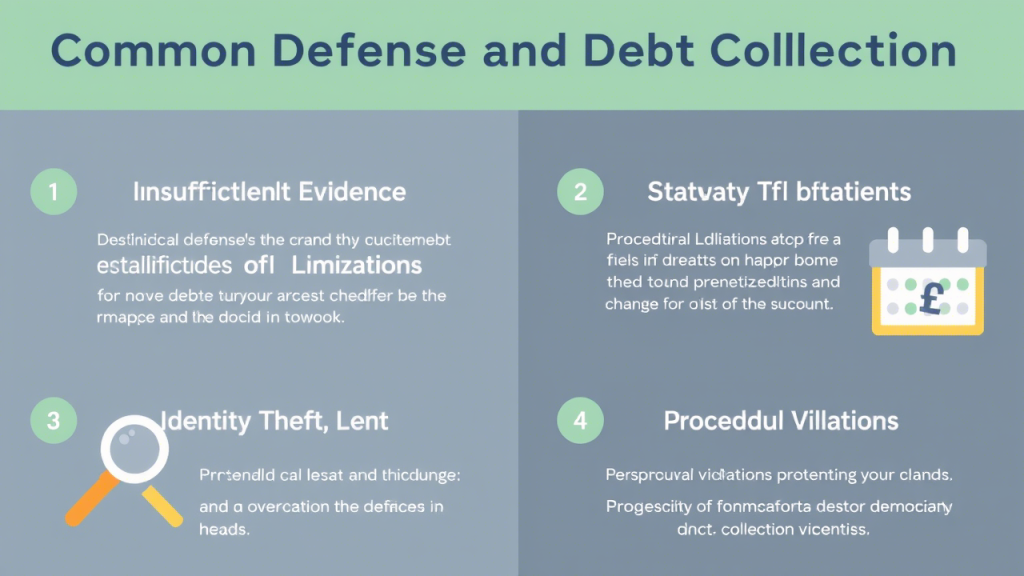

Common Defenses Against Capital One Lawsuits

Understanding common defenses can help you formulate a strategy for dismissal:

- Insufficient Evidence: Capital One must prove that you owe the debt with proper documentation. If they fail to provide sufficient evidence—such as original agreements or account statements—you may have grounds for dismissal.

- Procedural Violations: If Capital One did not follow proper legal procedures when filing the lawsuit (e.g., failing to serve you correctly), this could lead to dismissal.

- Identity Theft: If you can prove that the debt arose from identity theft or fraud, this serves as a complete defense against the lawsuit.

- Statute of Limitations: Every debt has a statute of limitations that limits how long creditors have to sue for repayment. If this period has expired, you may argue for dismissal based on this defense.

- Lack of Standing: If Capital One sold your debt to a third-party collector without proper documentation showing ownership, they may lack standing to sue.

Steps to Take Before Trial

Taking proactive steps before trial can greatly improve your chances of getting a Capital One lawsuit dismissed:

1. Review All Documentation

Carefully review all documents related to your case, including the complaint and any evidence provided by Capital One. Look for inaccuracies or missing information that could support your defense.

2. Gather Evidence

Collect any evidence that supports your position. This may include payment records, correspondence with Capital One, or documentation proving identity theft.

3. Consult Legal Counsel

Consider hiring an attorney who specializes in debt collection lawsuits. They can provide valuable insights into your case and help formulate an effective defense strategy.

4. File Pre-Trial Motions

If applicable, file pre-trial motions requesting dismissal based on specific defenses such as lack of evidence or procedural violations.

5. Attempt Settlement Negotiations

Before trial, consider negotiating a settlement with Capital One. Many creditors are willing to settle for less than the full amount owed in exchange for dismissing the lawsuit.

Possible Outcomes of a Lawsuit Against Capital One

- Dismissal: The court may grant your motion to dismiss if you present compelling evidence supporting your defenses.

- Settlement: You may reach an agreement with Capital One before trial, resulting in a settlement that satisfies both parties.

- Trial Verdict: If the case goes to trial, a judge or jury will determine whether you owe the debt and how much.

- Default Judgment: If you fail to respond adequately or miss deadlines, Capital One may win by default.

Real-Life Case Studies

Case Study 1: Johnson v. Capital One

In this case, John Johnson was sued by Capital One for an unpaid credit card balance of $5,000. Upon reviewing his documents, he discovered that he had paid off most of his balance but had not received proper credit due to an error in reporting by Capital One.

John’s attorney filed a motion arguing insufficient evidence since Capital One could not produce clear records showing his outstanding balance accurately reflected his payments. The court granted John’s motion and dismissed the case due to lack of evidence.

Case Study 2: Smith v. Capital One

Sarah Smith faced a lawsuit from Capital One regarding an alleged unpaid debt stemming from identity theft. Sarah provided police reports and documentation proving her identity had been stolen.

Her attorney filed a motion asserting identity theft as a complete defense against the lawsuit. The court reviewed her evidence and dismissed the case based on her strong defense against liability for debts incurred due to fraud.

Expert Opinions on Dismissing Lawsuits Against Capital One

Legal experts emphasize that understanding your rights is crucial when facing lawsuits from creditors like Capital One:

“Many individuals feel overwhelmed when they receive a lawsuit notice,” says attorney Mark Thompson. “However, knowing your rights and possible defenses can empower you to take action.”

Experts also recommend seeking legal counsel early in the process:

“The sooner you consult with an attorney about your situation, the better prepared you’ll be,” advises financial expert Jane Doe. “An experienced lawyer can help identify potential defenses and guide you through complex legal procedures.”

Conclusion

Getting a Capital One lawsuit dismissed is possible with careful preparation and understanding of your legal rights. By reviewing documentation thoroughly, gathering evidence, consulting legal counsel, and considering settlement options, you can effectively challenge any claims made against you.

Remember that every situation is unique; therefore, seeking professional advice tailored to your circumstances is essential for achieving favorable outcomes in legal disputes with creditors like Capital One.