Navigating the world of lawsuit settlements can be complex, especially when it comes to understanding tax implications. Whether you’ve won a personal injury case or settled a business dispute, knowing how much taxes you may owe is crucial. This article will delve into the legal process surrounding lawsuits, common defenses, steps to take before trial, possible outcomes, and real-life case studies. We will also explore expert opinions on the tax implications of lawsuit settlements while ensuring the content is easy to understand and SEO-optimized for Google Discover.

The Legal Process of Lawsuit Settlements

Initiating a Lawsuit

The legal process begins when a plaintiff files a complaint against a defendant. This document outlines the reasons for the lawsuit and the damages sought. The defendant then has an opportunity to respond, either admitting or denying the allegations.

Discovery Phase

Once the lawsuit is filed, both parties enter the discovery phase. This stage involves exchanging evidence, documents, and witness information. The goal is to gather enough information to prepare for trial or negotiate a settlement.

Negotiation and Settlement

Many lawsuits do not go to trial. Instead, parties often negotiate a settlement before reaching court. This can occur at any point during the legal process and may involve mediation or arbitration to facilitate discussions.

Finalizing the Settlement

If both parties agree on terms, they will draft a settlement agreement outlining the compensation amount and any other conditions. Once signed, this agreement is legally binding.

Common Defenses in Lawsuits

Understanding common defenses can help plaintiffs and defendants navigate their cases more effectively:

- Comparative Negligence: In personal injury cases, defendants may argue that the plaintiff shares some responsibility for the incident.

- Statute of Limitations: Defendants can claim that the lawsuit was filed too late according to state law.

- Consent: In some cases, defendants may argue that the plaintiff consented to the actions that led to the lawsuit.

- Lack of Evidence: Defendants may assert that there is insufficient evidence to support the plaintiff’s claims.

Steps to Take Before Trial

Before heading to trial, several steps can help strengthen your position:

- Gather Evidence: Collect all relevant documents, photographs, and witness statements.

- Consult Experts: Engage with legal and financial experts who can provide insights into your case.

- Consider Mediation: Explore mediation as an alternative to trial; it can save time and resources.

- Evaluate Settlement Offers: Assess any settlement offers carefully; consider both immediate financial needs and long-term implications.

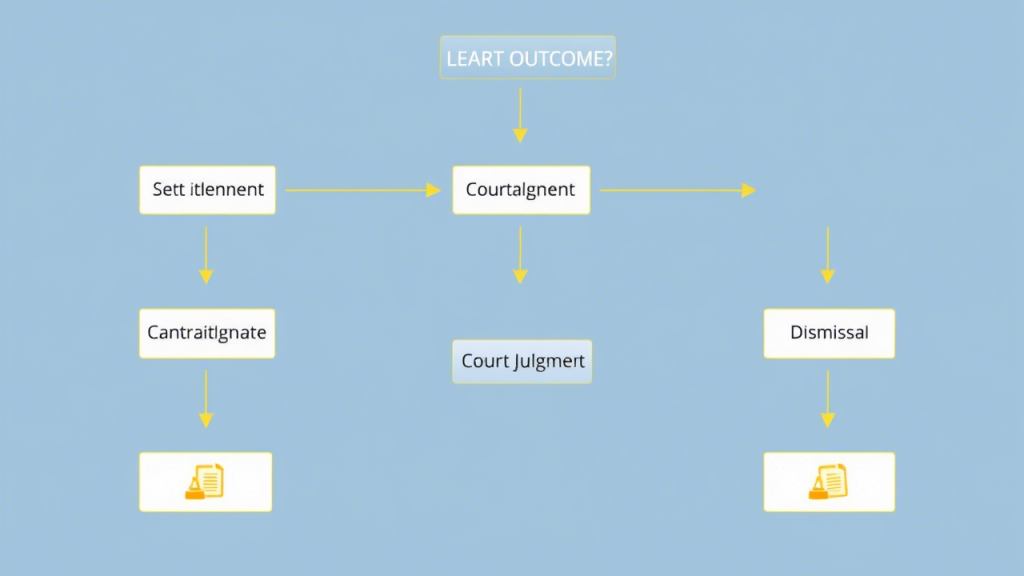

Possible Outcomes of Lawsuits

- Settlement Agreement: Most cases result in a settlement where both parties agree on compensation without going to trial.

- Court Judgment: If a case goes to trial, a judge or jury will deliver a verdict that may result in damages awarded to one party.

- Dismissal: A case may be dismissed if there is insufficient evidence or if procedural errors occur.

Tax Implications of Lawsuit Settlements

Understanding how much taxes you pay on lawsuit settlements depends on various factors:

General Tax Rules

According to IRS guidelines, most lawsuit settlements are considered taxable income unless specifically exempted by law. The key sections of the Internal Revenue Code (IRC) relevant to this topic include:

- IRC Section 61: States that all income from any source is taxable unless exempted.

- IRC Section 104: Excludes from gross income damages received due to personal physical injuries or physical sickness.

Types of Lawsuit Settlements and Their Tax Implications

- Personal Injury Settlements:

- Generally tax-free if related to physical injuries or illnesses.

- Portions compensating for emotional distress or punitive damages are taxable.

- Employment Lawsuits:

- Typically taxable; includes lost wages and emotional distress claims.

- Each component may be taxed differently.

- Non-Physical Injury Settlements:

- Settlements for defamation or emotional distress without physical injury are generally taxable.

- Business-Related Settlements:

- Usually taxable; however, related expenses (like legal fees) may be deductible.

Real-Life Case Studies

Case Study 1: Johnson v. ABC Corporation

In this employment discrimination case, Jane Johnson received a $200,000 settlement after proving wrongful termination due to gender discrimination. The settlement included $150,000 for lost wages (taxable) and $50,000 for emotional distress (also taxable). Jane consulted with a tax advisor who helped her understand her tax liabilities based on her settlement breakdown.

Case Study 2: Smith v. XYZ Insurance

In this personal injury case resulting from a car accident, Tom Smith was awarded $300,000 for medical expenses and pain and suffering related to his injuries. Since Tom’s injuries were physical in nature, his entire settlement was tax-free under IRC Section 104.

Expert Opinions

Legal experts emphasize the importance of consulting with tax professionals when dealing with lawsuit settlements:

“Understanding the nuances of tax implications in settlements is crucial for plaintiffs,” says attorney Mark Thompson. “Each case is unique; what’s tax-free for one person might not be for another.”

Conclusion

Navigating taxes on lawsuit settlements requires understanding both legal processes and IRS regulations. By knowing what types of settlements are taxable and consulting with professionals when necessary, individuals can make informed decisions about their financial futures following legal disputes.